One of the most exciting times in your life may very well be buying your first home and the prospect of home ownership, but with that comes some serious considerations. Don’t let the excitement of a new home overshadow the fact that financing is a very real thing that you’ll need to address.

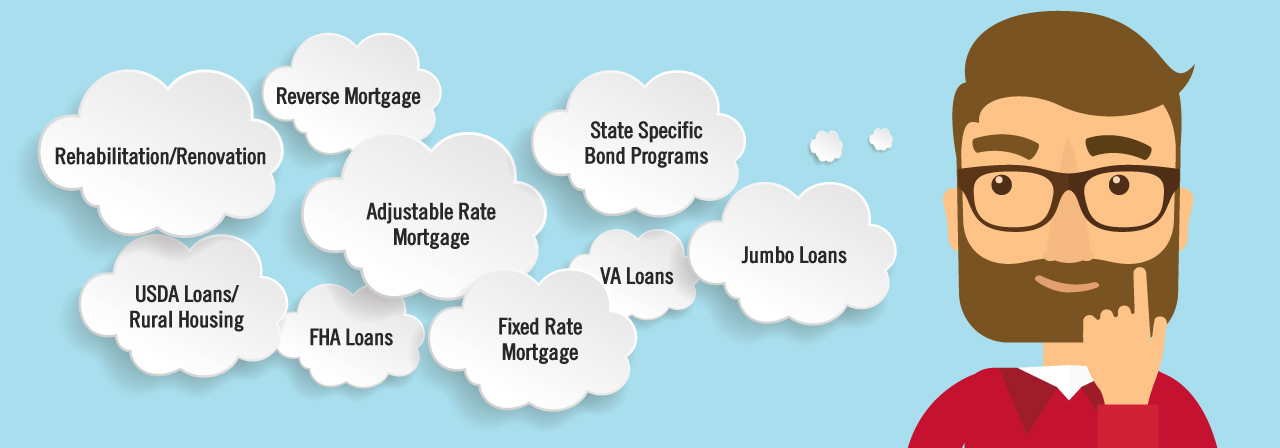

In all likelihood, your first home will be a financed venture, so we decided to help shine some light on mortgage loans and help you understand your loan options.

Keep It Simple, Go Conventional

Conventional mortgages are the staple for home financing. Conventional mortgages are the most widespread financial instrument in real estate and often have some of the best rates on the market. They are often the easiest to obtain and require as little as a 5% down payment, although down payments of 10% aren’t uncommon. Of course, good credit will show prospective lenders that you’re worthy of the best interest rates and lowest down payment options.

Is FHA the Way?

FHA loans are monitored and were created by the Federal Housing Administration. The FHA was established in the 1930s by the Federal Government to give American citizens a government-backed option to home financing. The FHA has been instrumental in helping veterans and less-privileged Americans afford homes since its creation.

FHA loans are available to anyone. While qualification standards are somewhat easier than conventional loans backed by financial institutions, interest rates can be slightly higher than the market average. Despite slightly higher interest rates, FHA loans are certainly a solid backup plan for folks looking to own their first home or purchase a second home in the event that conventional financing doesn’t work out.

USDA All Day!

USDA loans are often one of the most attractive loan options to first time home buyers, but qualification standards can be a little tricky. First of all, the USDA loan program was created in an effort to grow “rural” areas of the country by offering affordable home financing options to residents of those areas.

While the program was aimed at rural areas, you may find that rural is in fact a loose term when it comes to these loans and the areas which they cover. Many smaller cities are considered rural in the eyes of the USDA loan program.

USDA loans, much like FHA loans, have lower qualification standards, but potential borrowers must meet stringent income metrics and provide many years of documentation to prove their level of income. The application process itself can take considerably longer because of the back-and-forth communication from the loan originator (your bank) and the USDA itself. Getting started on USDA paperwork early will give you a chance to call an audible if the loan doesn’t look to be your best bet.

Armed Forces? Go VA!

If you’re active in the United States Military or a veteran of the Armed Forces, a VA loan may be exactly what the doctor ordered for you. VA loans are available exclusively for active military personnel and veterans, and all loans are backed by the Department of Veteran Affairs.

Since these loans are backed by the VA, no down payment is required for eligible veterans. Another major bonus of the VA-backed loans is that they don’t require mortgage insurance (common for most loans where the down payment is less than 20%). This means you can save the money you would normally put towards a down payment and save even more in the long run by avoiding mortgage insurance.

While the VA itself doesn’t have any credit requirements, since the loans originate from private lenders, some may have their own internal standards. Overall, though, VA loans are an excellent way to go if you qualify!

Get Prequalified

While this list of mortgages is in no way comprehensive, and depending on your personal situation even better options may be available. What’s important to know starting out is to begin your home buying process by getting prequalified. Prequalification gives you a leg up on the housing market and gives you a really solid idea of the type of mortgage you can get, at what rate, and for how much.

To get started, give one of the mortgage professionals at Tidewater Mortgage Services a call. Tidewater can get you prequalified the same day and give you all the options for owning your first home or getting back into the housing market. Don’t hesitate, though, when it comes to finding the perfect home, time is of the essence!